A recent study conducted by two faculty members from Ball State University sheds light on a significant correlation between local stock market downturns and an upsurge in antidepressant consumption among investors.

Dr. Chang Liu, assistant professor of finance, and Dr. Maoyong Fan, professor of economics, jointly authored the research paper titled “Stock Market and the Psychological Health of Investors,” published in The Financial Review. Their findings underscore a robust association between investment losses and the psychological well-being of investors, unaffected by local economic conditions.

Dr. Liu asserts, “This relationship, unaffected by local economic conditions, suggests that investment losses directly impact investors’ psychological health.” The researchers utilized a national individual-level medical dataset and leveraged the phenomenon of home bias in investment to arrive at their conclusions. They noted a heightened effect in regions with higher per capita dividend income, indicating a direct correlation between increased stock ownership and amplified psychological responses.

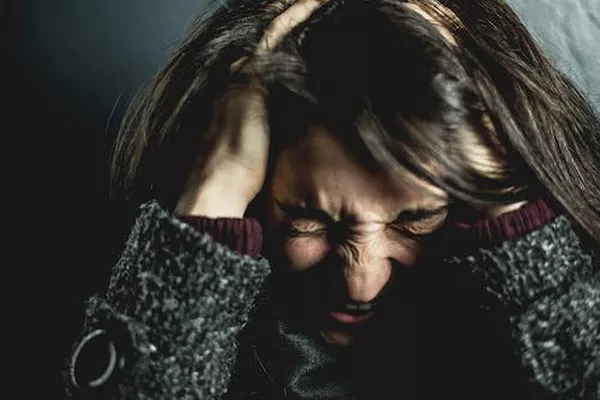

Moreover, the study discerns that portfolio losses, rather than local economic conditions, drive the surge in antidepressant usage during market downturns. Dr. Liu emphasizes the broader societal ramifications, stating, “The financial stress from stock market declines not only affects mental health but also leads to physical health problems such as insomnia and depression.”

Dr. Fan underscores the necessity for proactive measures in investor support and education, particularly during periods of market turbulence. “Our findings advocate for the inclusion of mental health resources in financial advising,” Dr. Fan remarks, “especially during times of market turbulence.” He highlights the imperative for policy interventions and educational initiatives to mitigate mental health risks associated with stock market participation, ensuring investors are equipped emotionally and financially to navigate market fluctuations.

Additionally, the research paper corroborates the loss aversion hypothesis, indicating that positive stock returns do not exert a comparable influence on antidepressant usage, further illuminating the intricate interplay between financial outcomes and psychological well-being.